Enhance Your Legacy With Specialist Depend On Structure Solutions

Specialist trust foundation services provide a durable structure that can guard your properties and guarantee your wishes are carried out exactly as planned. As we dive right into the nuances of count on structure remedies, we reveal the crucial aspects that can fortify your tradition and provide a long lasting effect for generations to come.

Benefits of Trust Foundation Solutions

Trust structure services supply a durable framework for safeguarding properties and making sure long-lasting economic safety for individuals and organizations alike. Among the key advantages of count on foundation solutions is property defense. By establishing a trust, individuals can protect their possessions from possible threats such as legal actions, lenders, or unforeseen economic obligations. This defense makes sure that the assets held within the depend on stay safe and secure and can be handed down to future generations according to the individual's desires.

Through counts on, individuals can outline just how their assets must be taken care of and dispersed upon their passing away. Trusts likewise provide personal privacy advantages, as possessions held within a count on are not subject to probate, which is a public and commonly extensive legal procedure.

Sorts Of Depends On for Heritage Preparation

When considering legacy planning, a vital aspect includes exploring different kinds of lawful tools designed to protect and distribute properties successfully. One typical sort of trust utilized in tradition planning is a revocable living trust fund. This count on allows individuals to preserve control over their assets throughout their lifetime while guaranteeing a smooth transition of these assets to recipients upon their passing away, staying clear of the probate procedure and supplying privacy to the family.

Philanthropic counts on are also popular for individuals looking to sustain a cause while keeping a stream of earnings for themselves or their beneficiaries. Special requirements depends on are important for people with disabilities to guarantee they receive essential care and support without jeopardizing federal government benefits.

Comprehending the different types of trusts offered for heritage preparation is critical in creating an extensive method that straightens with private objectives and concerns.

Selecting the Right Trustee

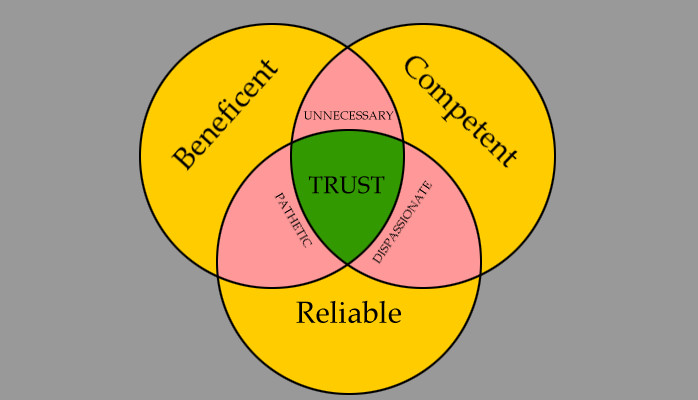

In the realm of legacy preparation, a critical aspect that requires careful consideration is the selection of an ideal person to satisfy the crucial duty of trustee. Choosing the right trustee is a choice that can significantly affect the successful execution of a count on and the fulfillment of the grantor's desires. When selecting a trustee, it is necessary to focus on high qualities such as reliability, monetary acumen, integrity, and a dedication go to the website to acting in the best passions of the recipients.

Ideally, the picked trustee ought to have a strong understanding of economic issues, be qualified of making sound financial investment decisions, and have the ability to navigate complicated lawful and tax demands. Furthermore, efficient communication abilities, focus to detail, and a determination to act impartially are also critical features for a trustee to possess. It is recommended to choose somebody that is trustworthy, responsible, and efficient in fulfilling the obligations and responsibilities related to the duty of trustee. By meticulously taking into consideration these factors and selecting these details a trustee that lines up with the values and goals of the count on, you can aid make sure the long-term success and preservation of your tradition.

Tax Obligation Effects and Advantages

Taking into consideration the financial landscape surrounding depend on frameworks and estate preparation, it is extremely important to look into the complex world of tax implications and benefits - trust foundations. When establishing a count on, understanding the tax effects is important for maximizing the benefits and minimizing possible responsibilities. Depends on provide numerous tax advantages relying on their structure and objective, such as lowering estate tax obligations, earnings taxes, and gift tax obligations

One significant benefit of certain trust fund frameworks is the ability to move assets to recipients with decreased tax obligation consequences. Irrevocable trusts can get rid of assets from the grantor's estate, possibly reducing estate tax responsibility. Furthermore, some trust funds enable for income to be distributed to beneficiaries, that may remain in reduced tax obligation brackets, causing overall tax This Site obligation savings for the household.

However, it is essential to keep in mind that tax obligation regulations are complex and conditional, stressing the necessity of speaking with tax specialists and estate preparation professionals to make certain conformity and make best use of the tax advantages of trust foundations. Appropriately browsing the tax effects of trust funds can result in considerable financial savings and an extra reliable transfer of wealth to future generations.

Actions to Developing a Trust

To establish a trust fund successfully, precise interest to detail and adherence to legal protocols are important. The primary step in establishing a trust is to plainly define the function of the depend on and the properties that will be included. This involves recognizing the recipients that will certainly gain from the trust fund and selecting a credible trustee to handle the assets. Next, it is important to select the type of trust that ideal straightens with your objectives, whether it be a revocable trust, unalterable trust, or living depend on.

Conclusion

To conclude, developing a depend on structure can provide many advantages for tradition planning, consisting of property protection, control over distribution, and tax obligation advantages. By selecting the suitable type of trust and trustee, individuals can secure their assets and guarantee their dreams are executed according to their desires. Understanding the tax obligation effects and taking the required actions to develop a count on can help strengthen your heritage for future generations.